|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

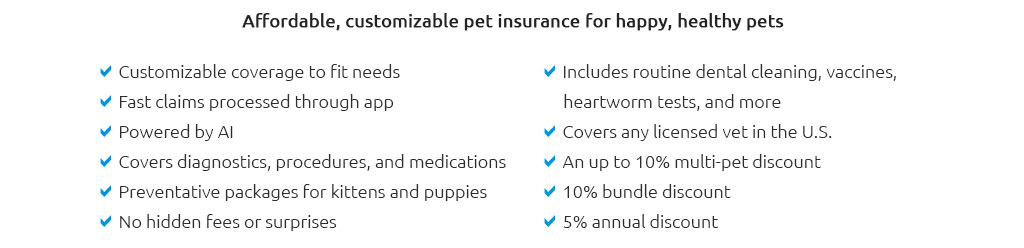

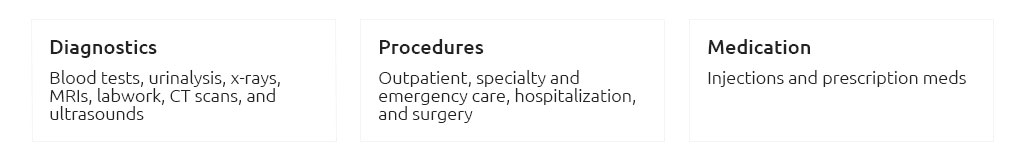

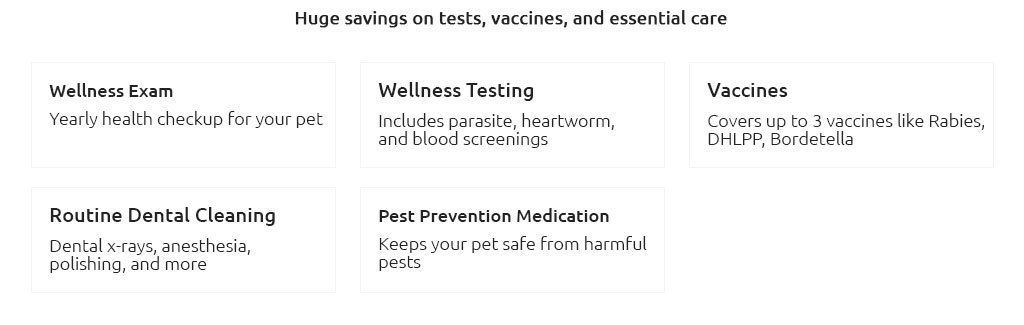

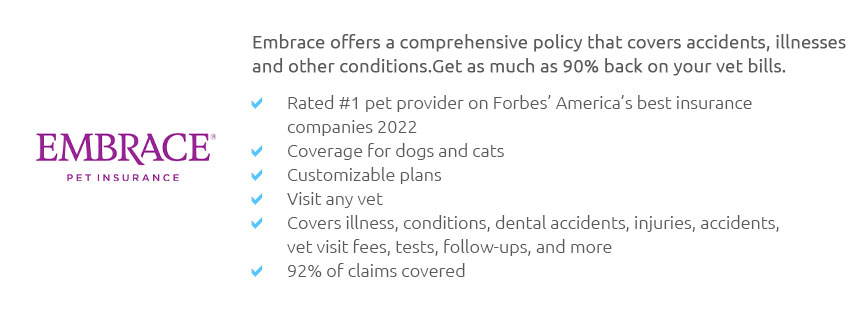

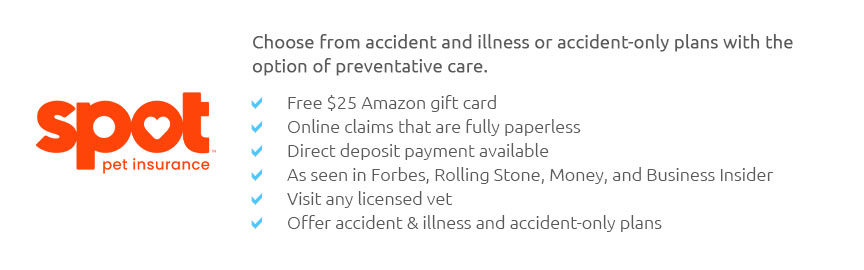

Pet Insurance for Ongoing Conditions: A Complete Beginner's GuideUnderstanding Pet Insurance for Chronic IllnessesPet insurance for ongoing conditions can be a lifesaver for pet owners. It provides financial support to cover the cost of treating chronic illnesses that require long-term management. What Qualifies as an Ongoing Condition?An ongoing condition refers to any illness or medical issue that requires continuous treatment over time. Common examples include diabetes, arthritis, and heart disease. The Importance of CoverageHaving coverage for ongoing conditions ensures that your pet receives the necessary care without causing a financial burden. It allows you to focus on your pet's health rather than worrying about the costs. Types of Pet Insurance PoliciesThere are various types of policies available, each offering different levels of coverage for ongoing conditions.

How to Choose the Right PolicySelecting the right policy depends on several factors, including your pet's health, age, and your budget. Assessing Your Pet's NeedsConsider any pre-existing conditions your pet may have and the likelihood of developing chronic illnesses in the future. Comparing QuotesIt is crucial to compare lifetime pet insurance quotes from different providers to find the best deal that suits your needs. FAQs About Pet Insurance for Ongoing Conditions

https://www.moneysupermarket.com/pet-insurance/pre-existing-conditions/

These specialist policies will cover most of your pet's existing health problems, although they may be more expensive than most existing policies. https://www.petplan.co.uk/pet-insurance/insurance-advice/pre-existing-conditions/

Some conditions can be covered straight away, some can be covered once your pet has been clear for a set period of time and other conditions can not be covered ... https://www.gocompare.com/pet-insurance/pre-existing-medical-conditions/

You can, but most standard pet insurers do not offer this level of cover. Instead, you'll need to compare quotes from specialist providers.

|